Gamma Capital AS is a family office. We invest globally in both private and publicly traded assets.

The Five Sources of Return

For an investment strategy to be profitable, there must be underlying profit opportunities which the strategy can exploit. Thus, profitable investing necessitates both an understanding of these underlying profit opportunities and the skills to harvest them. Underlying sources of return should not be confused with asset classes or investment strategies. An asset class, or investment strategy, can be comprised by one or several different sources of return. In our view, there are only five underlying reasons, or sources of return, available to the owner of capital. These five sources represent the foundation for our investment philosophy. We formulate sustainable investment strategies that seek to capture returns from some or all of these sources.

(1) Macro risk premiums

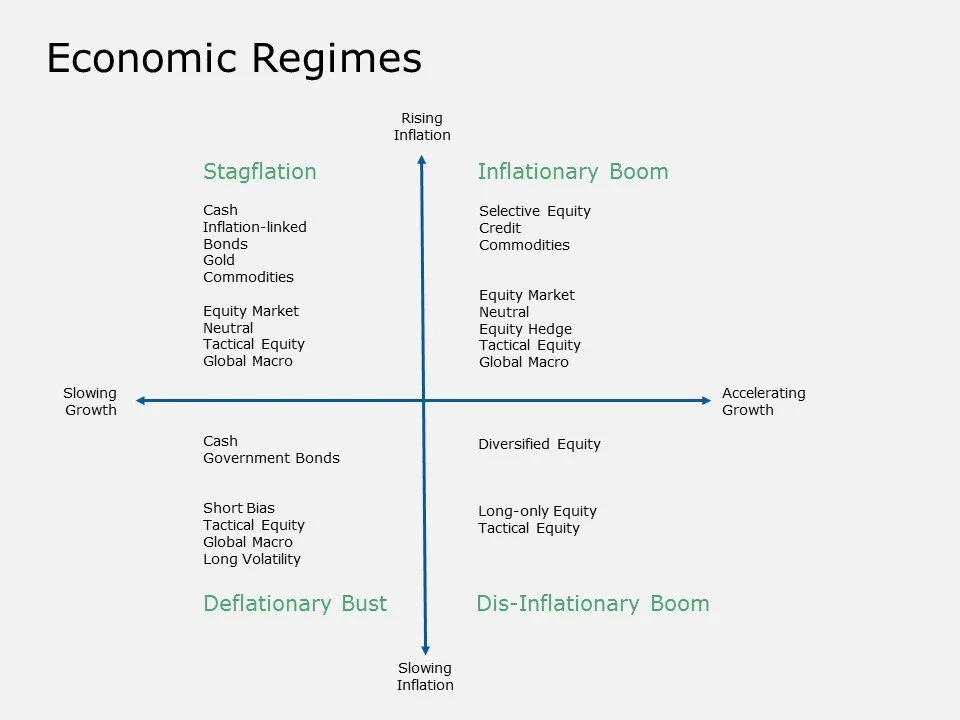

The expected return of risky assets reflects the risk of exposure to economic environments that are unfavourable for the assets. Economic environments can be described as combinations of growth and inflation, and the two vectors may be combined into four different economic regimes.

(2) Rebalancing bonus

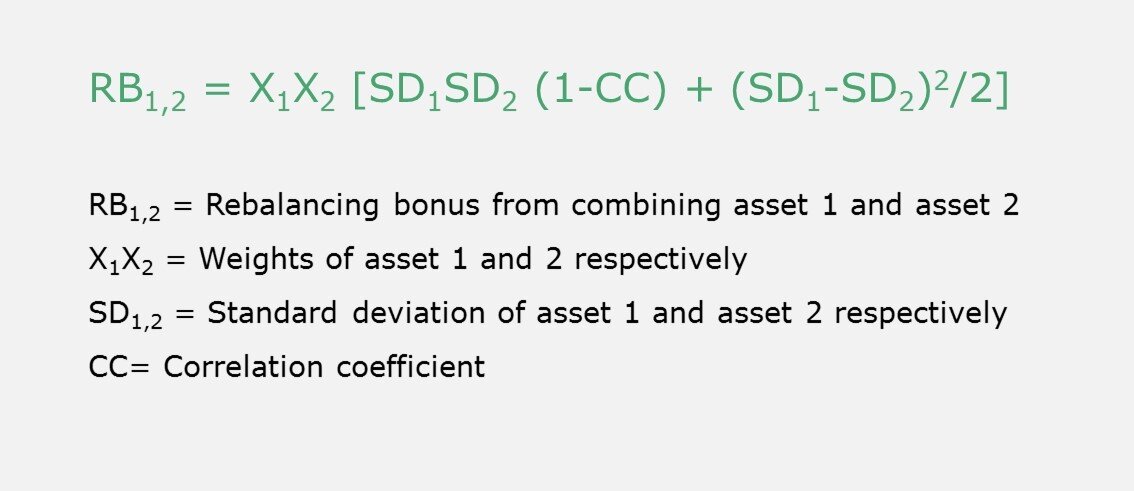

The rebalancing bonus stems from diversification, said to be the only ‘free lunch’ available to investors. Diversification increases the compounding of returns, by dampening return volatility.

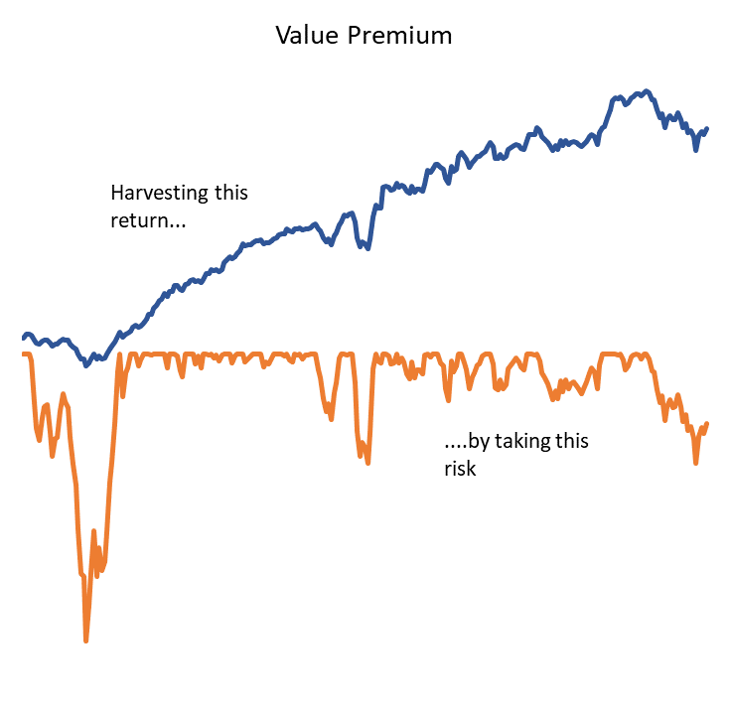

(3) Speculative risk premiums

Speculative risk premiums don’t come from asset class exposures but from intelligent investment strategies. Although there appear to be a winner and a loser in trades involving the transfer of risk or liquidity, speculative risk premiums are not zero-sum, because some investors are willing to pay others to take risk from them or gain access to liquidity.

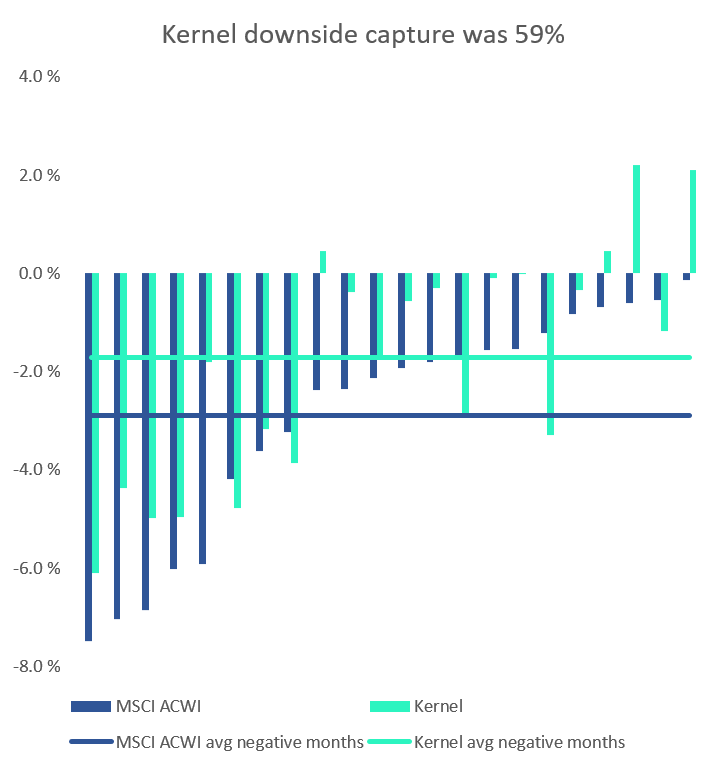

(4) Crisis Alpha

Crisis Alpha represents a sub-set of speculative risk premiums. Because investors, as a whole, are net-long equity, falling equity markets cause the most pain. Crisis alpha represents profits earned during equity market crises.

(5) Alpha

Alpha, strictly speaking defined as the return in excess of both macro and speculative risk premiums. It is the ‘holy grail’ of asset management, as it offers a return that is independent of macro risks. Because alpha returns are idiosyncratic, being solely generated by independent investment skill, true alpha is fully diversifiable.