Breaking the price-size link

Selecting stocks based on size do not work well. Neither does position sizing.

Selecting stocks based on market capitalization implies a belief that a larger market cap equals higher expected return. , However, In a study of U.S. stocks in the period from 1964-2013, Rob Arnott actually found a negative relationship between market cap and subsequent return. Likewise, determining position size based on market cap underperforms nearly all other sizing algorithms.

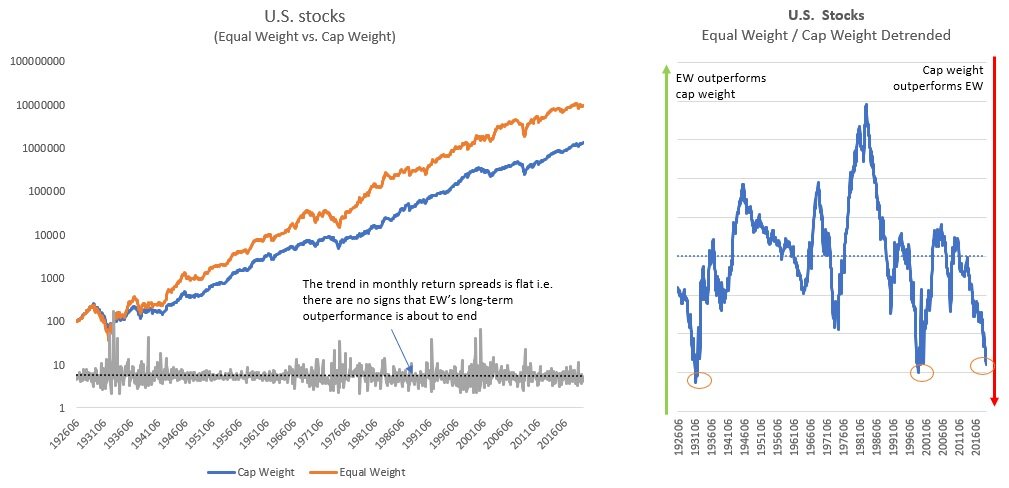

The U.S. cap-weighted portfolio has underperformed the equal-weighted by 1.6% p.a. since 1926

The long-term trend of equal-weight outperforming cap-weight shows no sign of abatment. It is, however, cyclical in nature and there are long spells of equal-weight underperforming cap weight.

Recent outperformance of cap-weighted has now reached an extreme

The 2009-current bull market has been different in that cap-weight outperformed equal-weight. It has now reached an extreme deviation form trend.

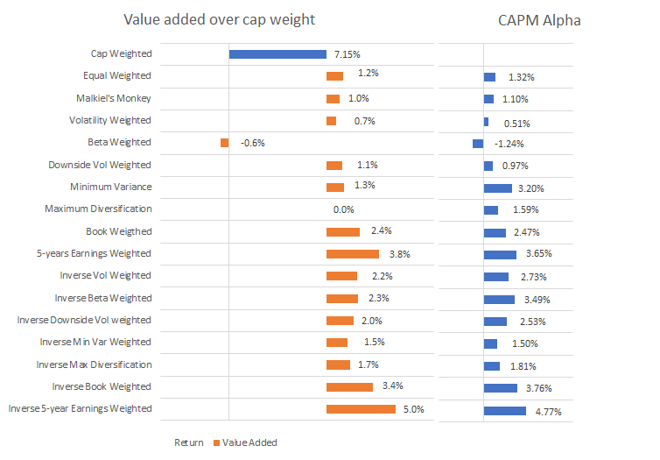

If you break the link between price and size - you can almost do ‘anything’ you want

In a study of global stocks Research Affiliates found that all position-sizing algorithms, with exception of overweighting high beta stocks, beat cap-weighting, even when turned upside down.

Time for reversal?

There are no signs of abatment in the long-run trend of cap-weighting underperforming equal-weighting of positions in the U.S. stock market. Thus we believe the extreme outperformance of cap-weighting witnessed during the current bull market is likely to be transitory. Deviation from long-term trend is now almost as extreme as it was following the roaring 1920s and dotcom bubble late 1990s. It is more extreme than during the ‘nifty 50’ epsiode of 1960s.